PALS Model Overview

Just like the name, the PALS model will be your best friend as you lay out your approach to ALM based investing. This model utilizes duration-optimization techniques to establish your liquidity profile, project the timing and magnitude of future cash flows, establish a duration target and provide a maturity bucket breakdown to meet your goals. PALS can even take it a step further and setup an optimized sector allocation utilizing risk/reward techniques and your investment policy. PALS data can be easily transported into the PAD model to create the underlying strategy reported on the Management Dashboard. For public fund portfolio managers looking for a way to benchmark and evaluate their performance, look no further than the PALS model to get you what you need.

Liquidity Profile

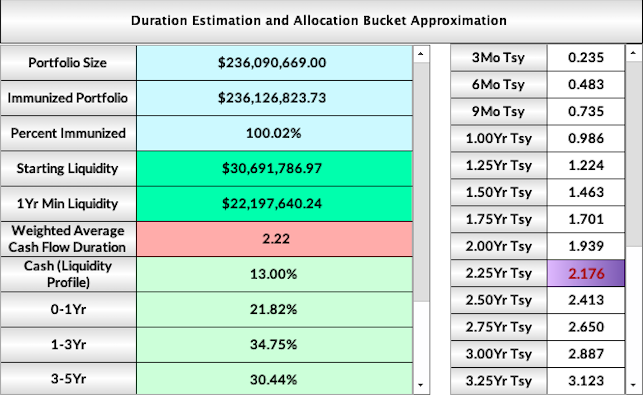

Establishing a liquidity profile is the first step in developing an appropriate strategy for liability-based public fund investors. PALS makes this straightforward with a simple and effective approach to analyzing liquidity needs. By utilizing several years of historical data, PALS can backtest cash flow data and see maximum drawdowns and approximate starting liquidity needs. Users are also able to put additional buffers into the liquidity profile for future expectations.

Duration Optimization

Unique and proprietary to MaxQ is the Duration Optimization feature available in PALS. Users are capable of defining future net cash flow expectations and establish timeframes in which expected net outflows will occur. PALS optimization will run duration calculations on each timeframe and produce a set of duration parameters required to meet liability expectations. The PALS system then uses a unique Immunization Weight feature to establish percentage immunizations throughout the tenor of the portfolio. This allows users to spread assets out across the legal tenor of the portfolio to maximize duration opportunities and match net outflow expectations.

Sector Risk/Reward Analysis

Another great feature of PALS is the ability to run risk/reward analysis on potential sector allocations applied to the portfolio. By utilizing the output of the Duration Optimization, users are presented with known maturity buckets and a duration target to meet the investing goals of the portfolio. Users can then use sector analytics to establish what assets in the specific timeframes established in the Duration Optimization should be used. This allows our users to create diversified portfolios with sector concentrations in areas that bring the best risk/reward profile.