REAL Model Overview

REAL is an auxiliary model that exists in the MaxQ ecosystem and is available to all of our subscription clients. If you utilize ALM techniques in your investing, REAL can be the perfect partner to truly understand the timing and magnitude of your future cash flows. REAL provides cash flow projections by utilizing expenditures like debt service and revenues like property tax to give a daily look into your institution’s liquidity profile. REAL has the ability to capture hundreds of user-defined categories for expenditures and revenues and integrates your portfolio real-time so users can see their asset picture relative to projected liabilities. REAL also contains a fantastic immunization tool to assign assets to specific liabilities, even if they don’t occur at the same time. REAL truly takes ALM investing to the next level.

Revenues and Expenses

One of the most difficult parts of managing a portfolio in the public fund space is understanding cash flow needs. With safety and liquidity as the primary objectives of public fund management, users need to be able to forecast and prepare for covering liabilities as they happen. REAL allows our users to establish revenue and expenditure forecasts while automatically embedding the current portfolio asset mix into the picture. This gives our users greater flexibility in establishing specific timeframes and transparency into appropriate investments to cover expected future outflows.

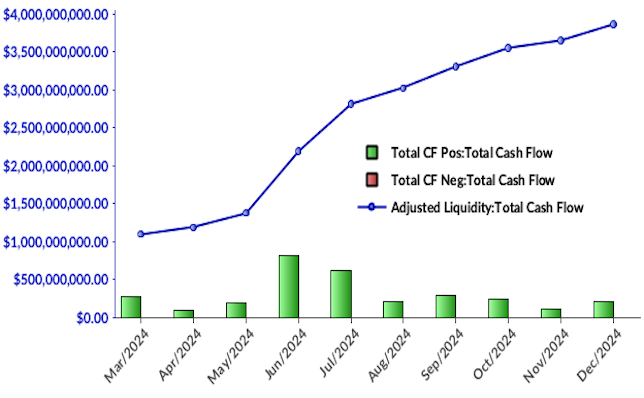

Cash Flow Schedules

REAL produces two different cash flow scenarios based on daily, monthly or yearly expectations. These cash flow schedules provide fantastic insight into how cash inflows and outflows affect the portfolio's liquidity and where portfolio assets might be placed to help immunize against liability outflows. These schedules embed current cash and security assets as well as user established revenues and expenditures to show expected net cash flows over the period selected.

Asset-Liability Immunization

One of the greatest features of REAL is it's ability to re-assign assets to match expected liabilities. This means the assets essentially become matched to known cash outflows. REAL even allows users to re-assign assets with different redemption dates and commit those assets to known liabilities in the near future. This is a valuable feature as often times finding an asset to perfectly redeem at the time needed could be difficult. REAL truly changes the game and adds incredible transparency into the cash flow forecasting process.